Have you ever wished you could earn money while recommending a bank you trust? AU Small Finance Bank’s affiliate program can make it possible! In this blog, we’ll look more into AU Bank affiliates. You can explore how you can make your network promote their impressive financial products, from credit cards and loans to savings accounts, all while earning attractive commissions. Get ready to learn insider tips, discover effective marketing strategies, and unlock a world of earning potential with AU Small Finance Bank’s affiliate program.

What is the AU Small Finance Affiliate Program

The AU Small Finance Bank Affiliate Program allows individuals or businesses to earn commissions by promoting the bank’s financial products and services, such as savings accounts and loans. Affiliates receive referral links and marketing materials to aid their promotions. They earn commissions based on the leads or sales generated from their efforts. The program often includes marketing support and a tracking dashboard to monitor performance, including clicks and commissions earned. Interested participants can join by signing up through the bank’s website or an affiliate network, making it a beneficial opportunity for those in affiliate marketing.

Commission Rate And Payout

| Details | AU Small Finance Bank Affiliate Program |

| Type of Campaign | Cost-Per-Acquisition (CPA) |

| Commission Rate | Upto ₹2,200 |

| Mode of Payment | bank transfers, e-wallets, or checks. |

Understanding How Does it Work

Here are some steps to know how the AU Small Finance Bank affiliate program likely works:

- Joining the Program: You won’t find a direct application form on AU Small Finance Bank’s website. Instead, you must sign up with an affiliate network that partners with them.

- Getting Your Affiliate Links: Once approved by the affiliate network, you’ll gain access to a dashboard where you can find unique affiliate links for various AU Small Finance Bank products (credit cards, loans, savings accounts, etc.). These links contain tracking codes that identify any users who click through them.

- Promoting AU Small Finance Bank Products: You can promote AU Small Finance Bank products through various channels:

Website or Blog: Publish informative content about personal finance, highlight the benefits of specific AU Small Finance Bank products, and strategically place your affiliate links.

- Social Media: Promote AU Small Finance Bank’s offerings through targeted social media campaigns.

- Email Marketing: If you have an email list, consider crafting compelling email campaigns showcasing AU Small Finance Bank’s products relevant to your audience.

- Tracking and Earning Commissions: When someone clicks on your unique affiliate link and completes a desired action (e.g., applying for a credit card), the affiliate network tracks this conversion. Once the conversion is confirmed by AU Small Finance Bank (which might involve a waiting period), you’ll earn a commission based on the pre-determined rate for that specific product.

- Receiving Payments: The affiliate network you joined will handle your payouts. They might have minimum payout thresholds you need to reach before receiving your commission (usually via bank transfer, e-wallet, or check).

Benefits of the AU Bank Affiliate Program

Here is a list of a few benefits provided by the AU affiliate program:

- Become a Financial Authority: Position yourself as a trusted source of financial knowledge by promoting valuable financial products. This can enhance your credibility and attract a loyal audience.

- Diversify Your Income Streams: The affiliate program offers a way to generate income alongside your existing revenue sources. The more successful you are at promoting AU Small Finance Bank products, the more you can potentially earn with other benefits depending on your performance.

- Flexible Work Style: Promote AU Small Finance Bank products on your terms and schedule. This is ideal for those who value flexibility and want to control their work hours.

- Scalable Earning Potential: There’s no limit to how much you can earn through the affiliate program. As your audience and marketing skills grow, so can your potential income.

- Access to Marketing Resources: Some affiliate networks offer additional resources to support your marketing efforts. This could include pre-made marketing materials, training programs, or access to exclusive data insights that can help you target your audience more effectively.

- Performance Incentives: Some affiliate networks might offer bonus structures that reward high-performing affiliates. This can further motivate you to optimize your marketing strategies and maximize your earnings.

- Promote Products You Believe In If you’re a fan of AU Small Finance Bank’s offerings, the affiliate program allows you to share your enthusiasm and help others make informed financial decisions.

Eligibility for the Program

- Should be a resident of India.

- Having a website or blog is preferred, but a strong social media presence can also work.

- Being able to create personal finance content could be beneficial.

- Some affiliate networks may have uncertain minimum traffic requirements.

- A clean online reputation is generally preferred.

AU BANK CREDIT CARD

AU Small Finance Bank offers a variety of credit cards to suit different needs and spending habits. Here are some of their most popular credit cards:

- AU LIT Credit Card:

This card is a great option for those who are new to credit cards or have a limited credit history. It has no annual fee and offers reward points on all spending categories.

- AU Altura Plus Credit Card:

This card is a good all-around option that offers cashback on all spending categories. It also has a reward program that allows you to earn additional points for meeting certain milestones.

- AU Altura Credit Card:

This card is a good option for those who are looking for a no-frills credit card with a low annual fee. It offers reward points on all spending categories.

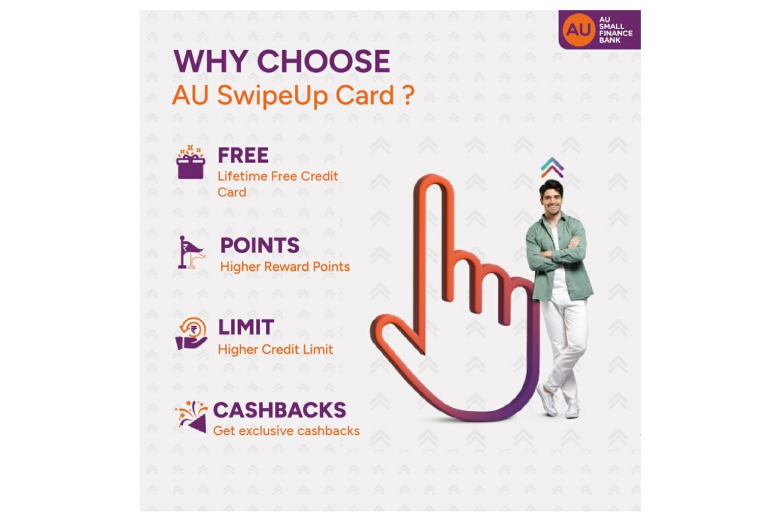

- SwipeUp Platform Credit Card :

The SwipeUp Platform offered by AU Small Finance Bank allows you to switch your credit card from a different bank to an AU Credit Card, ensuring it is to your current lifestyle.

Also Read: Bigcommerce Affiliate Program

In Conclusion

This blog series has empowered you to navigate the world of AU Small Finance Bank’s affiliate program. We’ve unpacked the program’s structure, explored potential commission rates across different affiliate networks, and highlighted the benefits of becoming a financial authority. Now, armed with the knowledge of eligibility requirements and the program flow, you’re ready to embark on your journey as an AU Bank affiliate.

Faqs on AU Bank Affiliate Program

Q. What is the AU Bank affiliate program?

A. The AU Bank affiliate program allows individuals and businesses to earn commissions by promoting AU Bank products and services.

Q. How do I join the AU Bank affiliate program?

A. You can join the AU Bank affiliate program by signing up on the AU Bank affiliate website and completing the registration process.

Q. What are the benefits of joining the AU Bank affiliate program?

A. Benefits include earning commissions, accessing marketing resources, and partnering with a reputable financial institution.

Q. How much commission can I earn with the AU Bank affiliate program?

A. Commission rates vary based on the specific products and services promoted; details are provided upon joining the program.

Q. Are there any costs associated with joining the AU Bank affiliate program?

A. No, there are no costs associated with joining the AU Bank affiliate program.

Q. What types of websites are suitable for promoting AU Bank products?

A. Websites focused on finance, banking, investment, and personal finance are suitable for promoting AU Bank products.

Q. How does the AU Bank affiliate program track referrals and commissions?

A. The program uses unique affiliate links and tracking cookies to monitor referrals and calculate commissions.

Q. What marketing tools and resources does AU Bank provide to affiliates?

A.AU Bank provides affiliates with banners, links, promotional content, and performance-tracking tools.

Q. How frequently does AU Bank pay affiliate commissions?

A. Affiliate commissions are typically paid every month, subject to meeting the program’s payout threshold.

Q. Does AU Bank offer support for its affiliates?

A. Yes, AU Bank offers dedicated support to help affiliates maximize their earnings and resolve any issues.